Global LCD panel utilization rate reached 80% in January

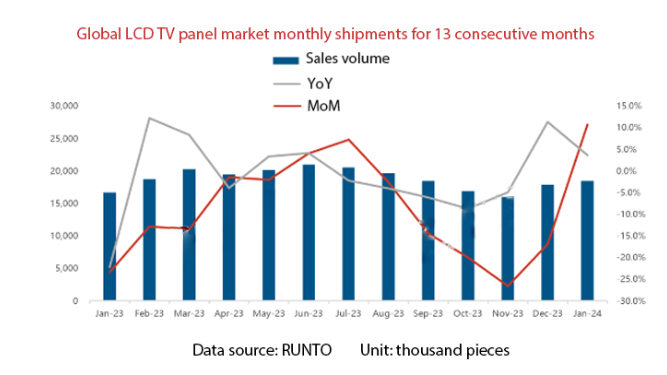

According to the “Global TV Panel Market Shipment Monthly Tracking” released by RUNTO, in January 2024, global large-size LCD TV panel shipments were 18.5M pieces, a year-on-year (YoY) increase of 10.7%, and the growth rate was the highest in the past 13 months.

The highest point since then, with a month-on-month (MoM) increase of 3.6%; the shipment area was 13.6M square meters, a YoY increase of 24.4%, and the MoM increase was basically the same.

That month, the average size of global LCD TV panel shipments was 49.6 inches, an increase of 2.8 inches from the same period in 2023, but a MoM decrease of 1.0 inches in that month.

The main reasons for the relatively high shipment volume of LCD TV panels in January and the recent high growth rate can be summarized as follows:

- First, major panel manufacturers have determined in advance that February will be revised for two weeks, so the January utilization rate has increased to about 80%, and complete machine manufacturers have also purchased goods in advance to prepare a certain amount of inventory.

- Second, January 2023 is the Chinese New Year month, with a low YoY base. However, in January 2024, both factory production and shipments are full.

- In addition, the expected increase in panel prices is also one of the driving factors.

Characteristics of the global LCD TV panel market in January 2024

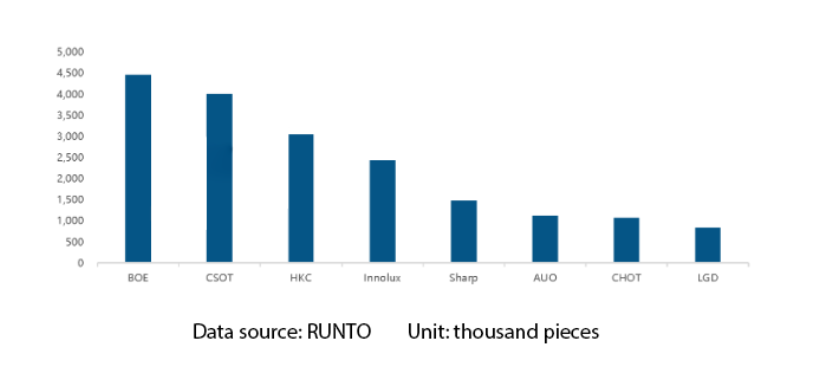

Mainland China’s panel factory’s share of shipments in the global market reached 68.1%. Although there was an increase of 0.9 percentage points MoM, it fell 4.1 percentage points YoY.

Under the production control strategy of mainland China panel factories, the market share remained stable at Seventy percent to the left.

- BOE (BOE Technology Group) shipped approximately 4.5 million pieces, ranking first, with a YoY increase of 10.2%. It maintained its leading market share in the 32-inch, 43-inch, and oversized 86-inch and 100-inch markets. Consolidated shipments of 55 inches and above accounted for 43.8% internally, an increase of 6.1 percentage points from the same period in 2023.

- CSOT (China Star Optoelectronics Technology) shipped approximately 4 million pieces, a Quarter-on-Quarter (QoQ) increase of 12.3% and 5.6% respectively. The shipment volume of three sizes: 55-inch, 65-inch, and 75-inch ranks first in the world. The ultra-large 98-inch product has been in the absolute lead for a long time, with a market share of more than 60%. The combined shipments of 55-inch and above products accounted for 61.0% internally, an increase of 10.4 percentage points from the same period in 2023.

- HKC (HKC Corporation) shipped approximately 3 million pieces, a YoY decrease of 2.8% and a MoM increase of 7.8%. In the ultra-large size 85-inch, shipments have ranked first for 7 consecutive months, with a market share of 36.3% that month, 12.4 percentage points ahead of second-place AUO. At the same time, 100-inch shipments have remained consistent with BOE and tied horizontally.

- The combined market share of Taiwanese panel manufacturers Innolux and AUO (AU Optronics) is 19.4%, which is basically the same as the same period in 2023 and a MoM decrease of 1.5 percentage points. In that month, AUO shipments decreased by 13.4% MoM, but increased by 20.5% YoY, Innolux shipments increased slightly QoQ.

- The combined market share of Japanese and Korean panel manufacturers was 12.6%, both increased QoQ, with increases of 4.1 and 0.6 percentage points respectively.

- Among them, Sharp’s shipments increased significantly by 113.5% YoY, the highest growth rate in the industry.

According to the “LCD TV Panel Price Forecast and Fluctuation Tracking in March 2024”, in March, major panel manufacturers will continue to report an increase of US$1-5 in all sizes.

The final transaction forecast is small and medium sizes will increase by US$1-2. Medium and large sizes will go up US $3-5.

In April, it is predicted that the large size will still increase by US$3, and it does not rule out expanding the increase. In terms of production capacity in March, the G10.5 production line will be fully operational.

The G8.5 production line is subject to sluggish IT demand, so there is still sufficient production capacity, and the utilization rate is expected to be about 80%.

2024 is a major year for sports events, including the UEFA European Championship, the Copa America, and the Olympic Games. The stocking period for TV marketing for these events is to be in the first half of the year.

Therefore, Runto Technology predicts that from March to the middle of the year, the capacity utilization rate of panel manufacturers will remain relatively high.

However, in the second half of the year, when the end market is expected to be weak, there is a high probability that capacity adjustments will be implemented to stabilize market prices.